- Home

- ScienceDiscover the latest updates from across the United States, including politics, culture, economy, and trending stories. Stay informed on the key events shaping the nation and the topics everyone’s talking about.

- EconomyOur Economy page provides comprehensive reporting on international financial systems, trade dynamics, development economics, and macroeconomic policy. Drawing on expert analysis and institutional data, we illuminate the interconnected nature of global markets and their real-world implications for governance and inequality.

- HealthWe examine global health issues through the lens of policy, access, equity, and innovation. From pandemics and healthcare infrastructure to mental health and biotechnological breakthroughs, our health reporting is rooted in empirical data, expert insight, and a commitment to understanding health as a cornerstone of human development.

- HistoryThis section revisits critical junctures in world history, emphasizing the relevance of historical events in shaping present-day global affairs. Through scholarly narratives and fact-anchored storytelling, we uncover the often-overlooked patterns, power structures, and human decisions that have left a lasting imprint on international relations and societies.

- PoliticsOur Politics section offers in-depth analysis of international political developments, ideological movements, and institutional shifts. With a focus on global governance, diplomacy, and geopolitical strategy, we provide nuanced reporting that transcends partisan narratives and situates events within their broader historical and structural contexts.

- War & ConflictThis section delivers meticulous coverage of international conflicts, civil wars, military strategies, and peace negotiations. We prioritize geopolitical context, long-term impact, and the role of state and non-state actors—eschewing sensationalism in favor of sober, historically informed analysis.

- TechnologyWe critically examine the global technology landscape—from artificial intelligence and cybersecurity to digital policy and ethical innovation. Our reporting focuses not just on what is being built, but why it matters: how technological change influences governance, economy, security, and human life on a planetary scale.

- Features

- Home

- ScienceDiscover the latest updates from across the United States, including politics, culture, economy, and trending stories. Stay informed on the key events shaping the nation and the topics everyone’s talking about.

- EconomyOur Economy page provides comprehensive reporting on international financial systems, trade dynamics, development economics, and macroeconomic policy. Drawing on expert analysis and institutional data, we illuminate the interconnected nature of global markets and their real-world implications for governance and inequality.

- HealthWe examine global health issues through the lens of policy, access, equity, and innovation. From pandemics and healthcare infrastructure to mental health and biotechnological breakthroughs, our health reporting is rooted in empirical data, expert insight, and a commitment to understanding health as a cornerstone of human development.

- HistoryThis section revisits critical junctures in world history, emphasizing the relevance of historical events in shaping present-day global affairs. Through scholarly narratives and fact-anchored storytelling, we uncover the often-overlooked patterns, power structures, and human decisions that have left a lasting imprint on international relations and societies.

- PoliticsOur Politics section offers in-depth analysis of international political developments, ideological movements, and institutional shifts. With a focus on global governance, diplomacy, and geopolitical strategy, we provide nuanced reporting that transcends partisan narratives and situates events within their broader historical and structural contexts.

- War & ConflictThis section delivers meticulous coverage of international conflicts, civil wars, military strategies, and peace negotiations. We prioritize geopolitical context, long-term impact, and the role of state and non-state actors—eschewing sensationalism in favor of sober, historically informed analysis.

- TechnologyWe critically examine the global technology landscape—from artificial intelligence and cybersecurity to digital policy and ethical innovation. Our reporting focuses not just on what is being built, but why it matters: how technological change influences governance, economy, security, and human life on a planetary scale.

- Features

Now Reading: U.S. 25% Tariffs on Japan, South Korea Shake Trade

-

01

U.S. 25% Tariffs on Japan, South Korea Shake Trade

- Home//

- Science//Discover the latest updates from across the United States, including politics, culture, economy, and trending stories. Stay informed on the key events shaping the nation and the topics everyone’s talking about.

- Economy//Our Economy page provides comprehensive reporting on international financial systems, trade dynamics, development economics, and macroeconomic policy. Drawing on expert analysis and institutional data, we illuminate the interconnected nature of global markets and their real-world implications for governance and inequality.

- Health//We examine global health issues through the lens of policy, access, equity, and innovation. From pandemics and healthcare infrastructure to mental health and biotechnological breakthroughs, our health reporting is rooted in empirical data, expert insight, and a commitment to understanding health as a cornerstone of human development.

- History//This section revisits critical junctures in world history, emphasizing the relevance of historical events in shaping present-day global affairs. Through scholarly narratives and fact-anchored storytelling, we uncover the often-overlooked patterns, power structures, and human decisions that have left a lasting imprint on international relations and societies.

- Politics//Our Politics section offers in-depth analysis of international political developments, ideological movements, and institutional shifts. With a focus on global governance, diplomacy, and geopolitical strategy, we provide nuanced reporting that transcends partisan narratives and situates events within their broader historical and structural contexts.

- War & Conflict//This section delivers meticulous coverage of international conflicts, civil wars, military strategies, and peace negotiations. We prioritize geopolitical context, long-term impact, and the role of state and non-state actors—eschewing sensationalism in favor of sober, historically informed analysis.

- Technology//We critically examine the global technology landscape—from artificial intelligence and cybersecurity to digital policy and ethical innovation. Our reporting focuses not just on what is being built, but why it matters: how technological change influences governance, economy, security, and human life on a planetary scale.

- Features//

U.S. 25% Tariffs on Japan, South Korea Shake Trade

Jhon SmithEconomyJuly 8, 202582 Views

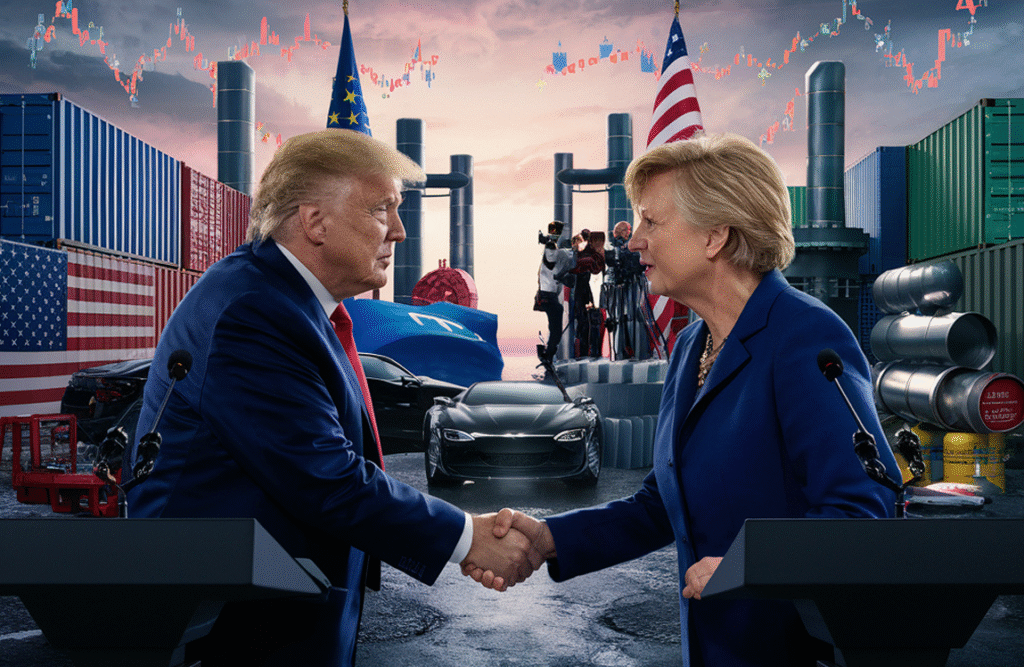

The United States has announced a 25% tariff on selected imports from Japan and South Korea, with enforcement delayed until August 1. The move, confirmed by U.S. Trade Representative Katherine Tai on July 8, is raising concerns among global investors and trade analysts. While not immediate, the delay is seen as a window for talks, not a sign of reversal.

Tariffs are now taking center stage again in international policy. Used as a tool to rebalance trade, they often create ripple effects across multiple sectors. In this case, industries like automobiles, semiconductors, and machinery may face the greatest pressure.

According to Reuters, both Japan and South Korea are preparing for urgent discussions to avoid the full impact of the new tariffs. Tokyo has expressed “strong regret,” while Seoul called the decision “deeply disappointing.” Officials in both capitals are considering targeted countermeasures, but no final decisions have been made.

This latest development adds strain to already sensitive economic ties in the Asia-Pacific region. It also highlights growing trade tensions between the U.S. and its traditional allies. Many experts see these tariffs as part of a broader strategic shift, rather than a temporary reaction.

Economists warn that if the measures go forward, global supply chains could face disruptions. Market analysts also predict short-term volatility in foreign exchange and equities. As the August deadline approaches, global attention will remain fixed on the outcomes of ongoing trade discussions.

Tariffs as a Tool of Economic Pressure

Tariffs are often used by governments to apply economic pressure during trade disputes or negotiations. For the United States, this tool serves both economic and strategic goals. When diplomacy stalls, tariffs become a way to protect local industries or push foreign governments toward specific agreements.

Historically, the U.S. has used tariffs in several high-profile cases. During the Trump administration, tariffs were placed on Chinese goods, sparking a trade war. This led to significant disruptions in global markets but also forced trade talks. In the 1980s, similar actions were taken against Japan over car exports. That dispute reshaped global auto supply chains.

The latest 25% tariffs targeting Japan and South Korea follow a familiar pattern. While designed to correct trade imbalances, they risk harming key sectors. In Japan, the automotive industry could face higher costs and reduced demand in U.S. markets. For South Korea, electronics and semiconductor firms may suffer delays and pricing issues.

According to Bloomberg and Reuters, both countries rely heavily on exports to the U.S. As a result, the tariffs could affect thousands of jobs and billions in trade value. Despite the pressure, both governments have called for dialogue rather than retaliation.

Tariffs may offer short-term leverage, but they also carry risks. Industries caught in the middle often face rising costs and uncertain outlooks. As global supply chains remain fragile, experts warn that even targeted tariffs can trigger wider economic effects.

Read More:

Japan and South Korea’s Response to Tariffs

Japan and South Korea have reacted swiftly to the U.S. decision to impose 25% tariffs, calling the move unexpected and unfair. The two governments released official statements calling on Washington to rethink its stance ahead of the August 1 deadline. The tone remains diplomatic, but the message is firm.

In Tokyo, Japan’s Ministry of Economy, Trade and Industry labeled the tariffs “unilateral and damaging”. Officials emphasized that Japan has always followed international trade rules. Meanwhile, South Korea’s Trade Minister stated the action could “harm decades of cooperation” between Seoul and Washington.

Behind the scenes, negotiations are already underway. According to Nikkei Asia, senior trade officials from both countries are seeking direct talks with U.S. counterparts. Their goal is to delay or cancel the tariffs through diplomatic channels. Some progress has been reported, but no breakthrough yet.

Domestic pressure is also building in both nations. Japan’s corporate executives are pushing the government to adopt a strong stance. Auto and machinery firms warn that long-term tariffs could lead to factory slowdowns. In South Korea, public concern is growing, especially in export-heavy regions like Incheon and Ulsan.

Leaders in both countries must now balance diplomacy with internal demands. While avoiding a public confrontation, they are under pressure to protect local industries and workers. The use of tariffs in this context is more than a trade decision—it’s a political test at home and abroad.

Global Trade Risks and Tariff Consequences

The US imposition of 25% tariffs on imports from Japan and South Korea has triggered significant market volatility worldwide. Investors responded quickly, with stock indices in Asia, Europe, and the U.S. dipping hours after the announcement. The Japanese yen weakened, and the South Korean won also dropped slightly, reflecting market uncertainty.

Tariffs can trigger broader reactions beyond the targeted countries. Experts warn of a possible chain response, where affected nations may consider their own countermeasures. While both Japan and South Korea are calling for talks, analysts say retaliation remains a real risk. If that happens, the World Trade Organization (WTO) could be drawn in to manage disputes.

Supply chains are already feeling the strain. Companies that rely on key inputs from Japan or South Korea are rethinking shipment schedules. Some may seek new suppliers, while others could delay production. Such changes can drive up expenses, potentially leading to higher prices for consumers.

According to Bloomberg, electronics, auto parts, and industrial goods are the most exposed sectors. In a global economy still recovering from earlier disruptions, tariffs create added pressure. Even a short-term disruption can lead to long-term changes in trade patterns.

In the retail sector, U.S. buyers may face delays or increased costs on imported goods. As global businesses prepare for possible impacts, many are urging leaders to resolve the issue quickly to avoid lasting damage.

Expert Opinions and Economic Forecasts on U.S. Tariffs

Experts across the trade and finance sectors are closely watching the U.S. tariff decision on Japan and South Korea. Many view it as more than a simple trade move. It could reshape global policy if not managed carefully.

Dr. Michael Adams, a trade economist at Georgetown University, noted that “tariffs used in this way carry political weight, not just economic costs.” He added that such steps can erode long-standing alliances. Soo-jin Lee, a Seoul-based analyst, warned that “a small tariff today can become a trade wall tomorrow.”

Forecasts for global trade growth have already shifted. The World Bank had predicted moderate recovery in Q3, but that may now slow. According to a report by Bloomberg Economics, a full implementation of these tariffs could lower U.S.‑Asia trade volume by 1.2% this quarter. That figure could grow if more tariffs follow.

Market researchers also point out that tariffs can trigger lasting shifts. Companies may relocate supply chains or delay investment decisions. This creates further instability in regions still coping with post-pandemic recovery.

Though officials in Washington deny any intention of a trade war, comparisons are being drawn to past disputes with China. “We’re not there yet,” said trade policy expert Anna Torres, “but early signs are similar.” She stressed the need for transparent negotiations to prevent escalation. As discussions continue, global institutions like the WTO and IMF are urging restraint and dialogue to avoid long-term disruption.